Kenyan Protests, Part Two: How not to clean up a fiscal mess

Generalized erosion of fiscal pact and trust in government raise the specter of widespread tax evasion, proliferation of informality, and unmanageable deficits

This is the second of a three part series on the current economic and political crises in Kenya. Part One addresses the political foundations of the crisis. Part Two will tackle the real economic challenges that the current administration inherited, and arguably made worse. Finally, Part Three will conclude with some thoughts on the set of bad options on the table for the administration.

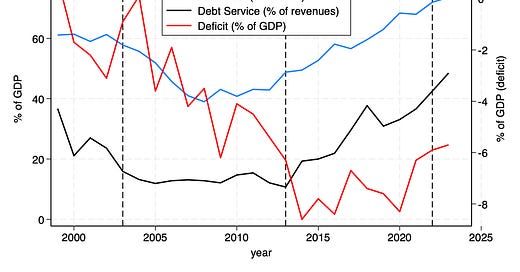

I: The making of a fiscal mess

On July 11, 2024 President William Ruto dissolved his Cabinet following weeks of protests against his administration. As discussed in the previous post, the immediate trigger of the countrywide popular revolt was a raft of tax increases in the 2024 Finance Bill. But the grievances were deeper. Ruto came into office with a legitimacy deficit that has proven difficult to shake off. His Cabinet was one of the weakest in Kenya’s history and had come to symbolize the out-of-touch incompetence and arrogance towards the public associated with the administration. Real incomes were…